Information on Nonghyup’s jeonse loan that needs to be studied in order to make an accurate decision

If you need an unexpected large amount of money or if the interest rate on existing products under repayment is burdensome, you can easily transfer to an interest rate that is not burdensome if you are familiar with the common sense of loans. However, there are many people who avoid studying in detail for the reason that it is complicated, and there are many people who say it is difficult to repay because they cannot get the cause to fix it, so I would like to summarize the common sense of loans through this article. In addition, if you study in detail, you can use it not only for private life funds but also for investment funds, so please read it if you have any thoughts on financial technology and investment.

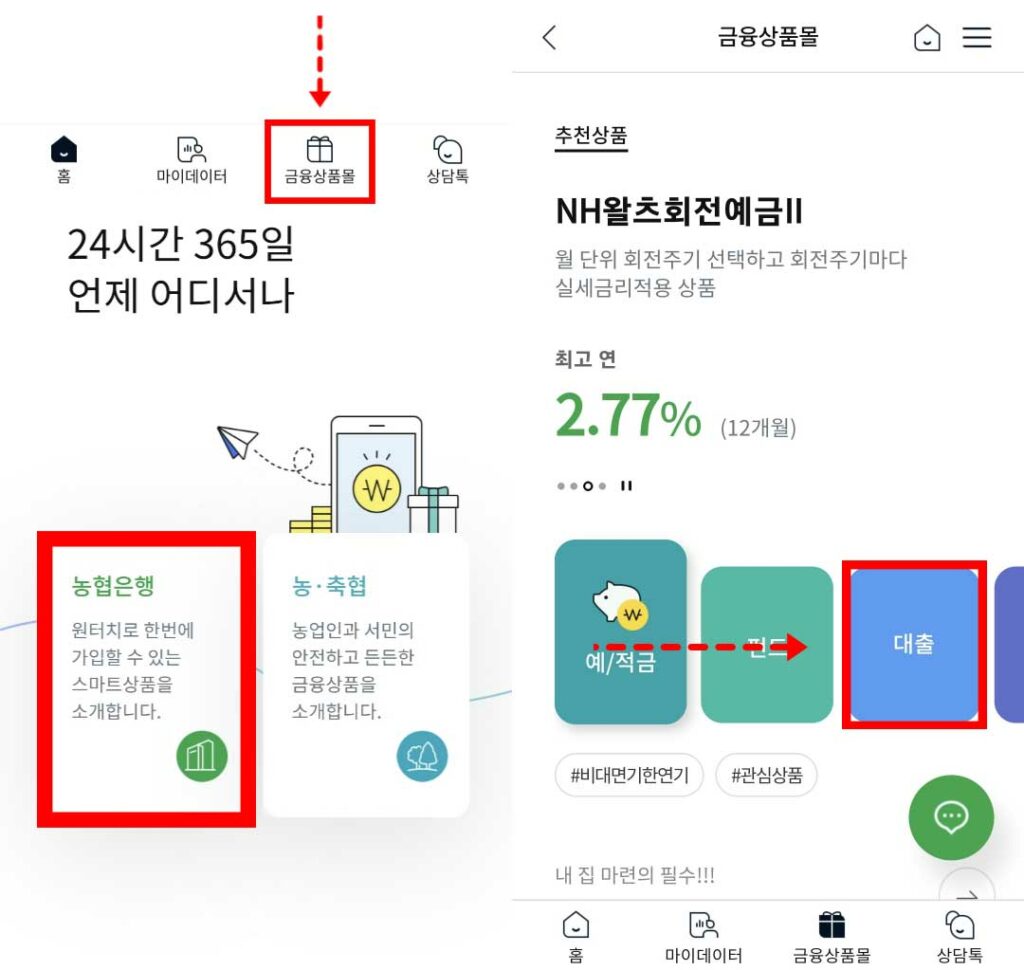

What I need to know is that I will explain about Nonghyup’s jeonse loan!

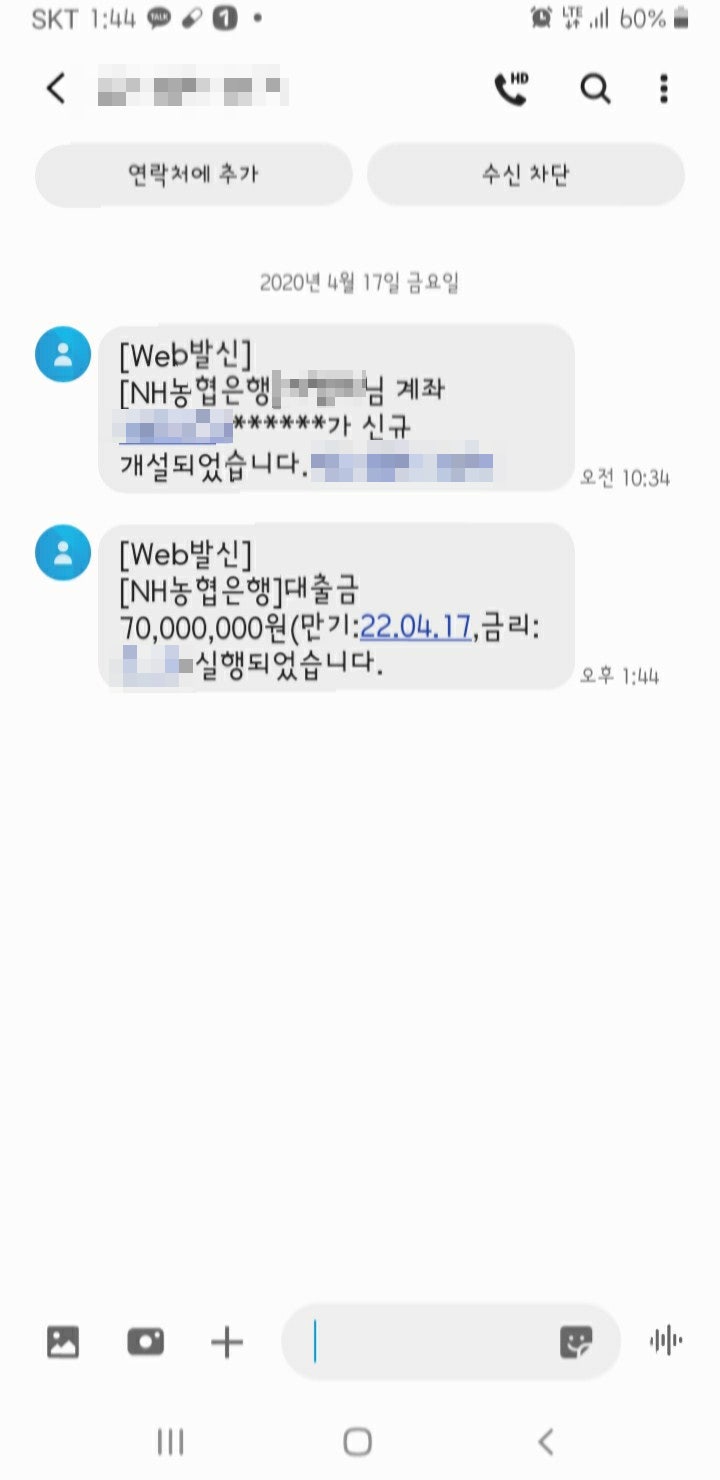

The difference between the first finance to which commercial banks belong and the second finance, which includes credit specialists and securities firms, is that there is a difference in ordinary interest rates, but if interest rates are low, it should not be judged to be much more profitable. The banking sector may have a significantly lower repayment burden because it is approved at 4.59% interest rate, but it is difficult to receive a large amount because the loan limit is limited to 75% of the annual salary. In addition, the loan screening results may be determined by the applicant’s credit, so you should first consider the purpose of using cash, then decide which one to choose between the interest rate and the maximum limit, and use the loan product first.

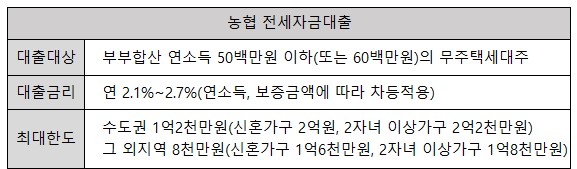

You can find a strange kind of loan.Agricultural Cooperative Federation Fund Loan Related Information

If the credit score is very bad or it is difficult for the financial sector to raise extra funds due to workouts, there is no need to panic because there is a way to apply for loan products for ordinary people operated by government agencies. State institutions are helping those who have few assets or have difficulty repaying due to the burden of existing loans and interest, and those who are sincere can use more than 0.6%, and the loan limit is around 7 million won and the repayment period is up to 9 years. More information on this will be provided later.

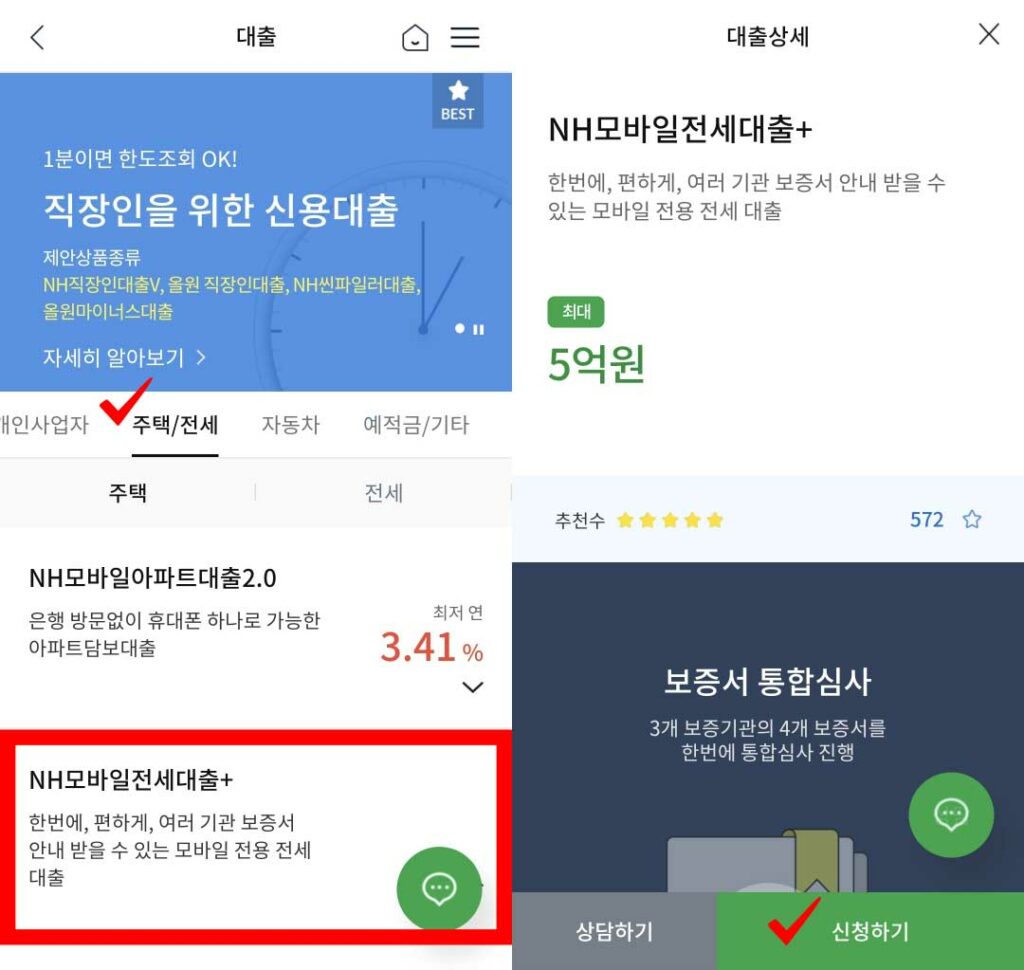

Latest information on mortgage loans and investment agricultural cooperative lease loans that can develop profits

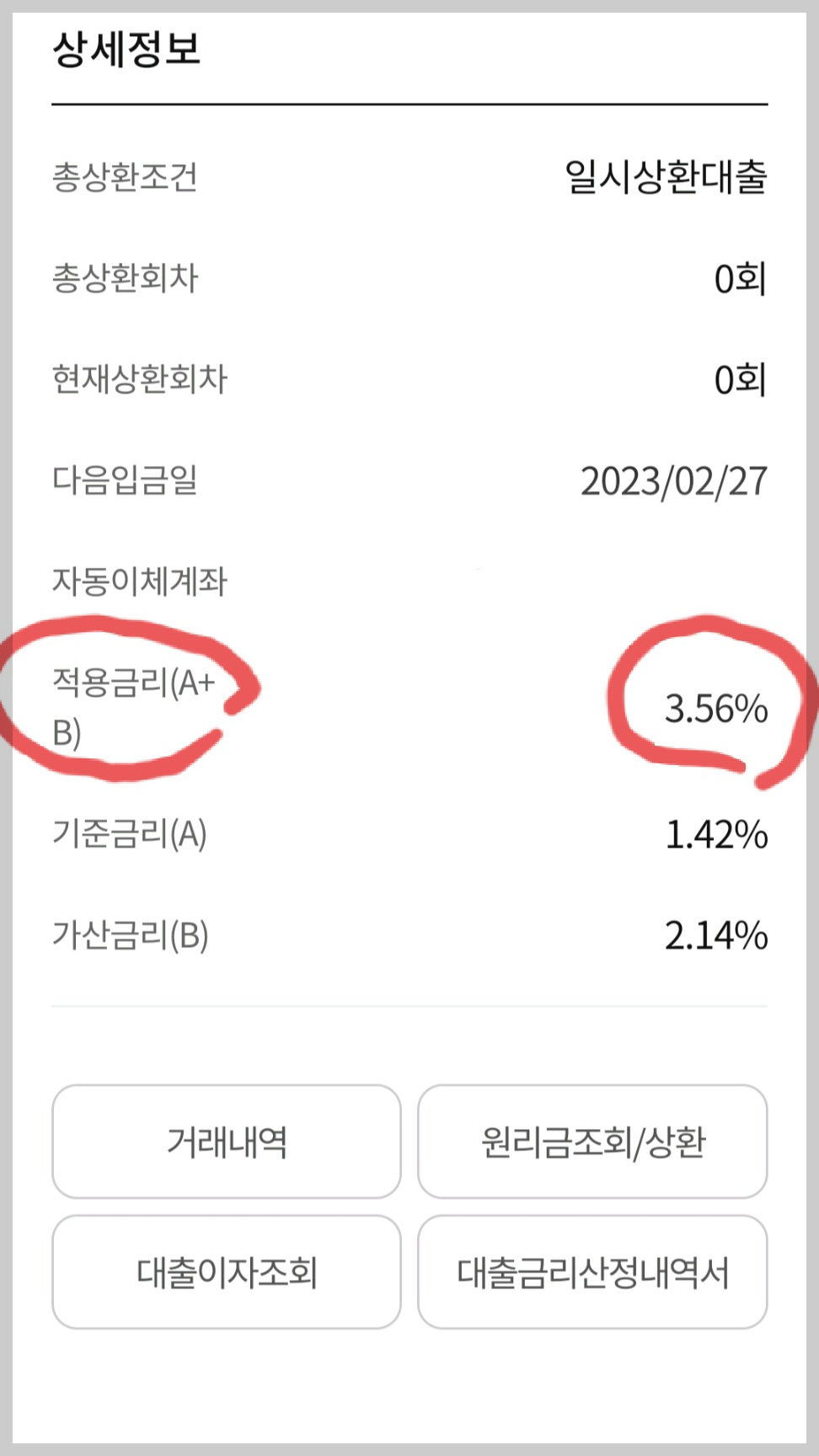

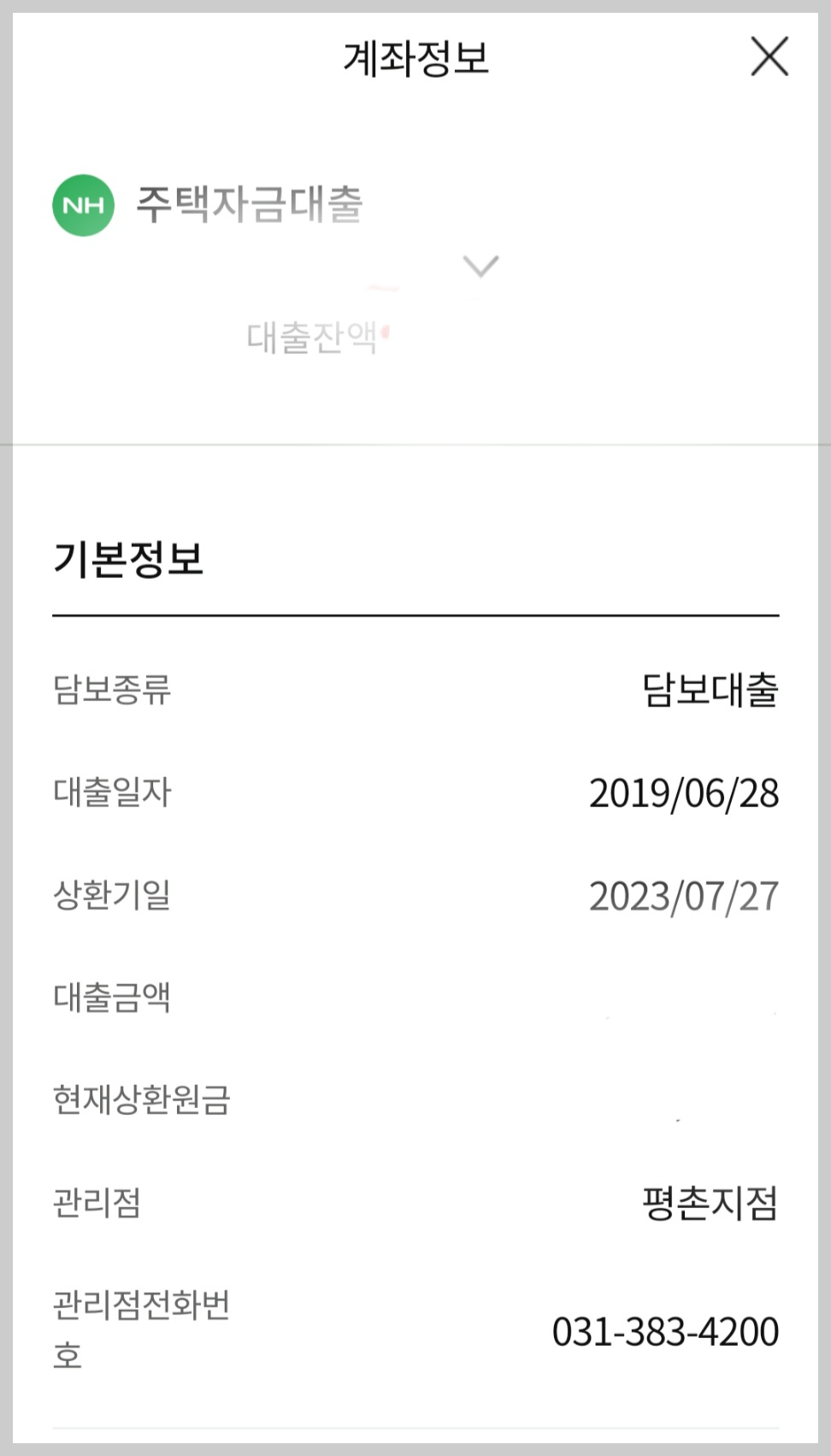

In addition, many people are interested in speculation due to the boom in the real estate economy, and even if they lack funds, they can step in without any major problems if they understand the most basic information on mortgage loans, including LTV or DTI. However, unlike ordinary products, the limit has risen proportionally to the valuation, and as you can borrow up to 50% of LTV, it is dangerous if you do not prepare carefully If you look into it in detail, you can use it at an interest rate of 2.74% or more, but if you repay the principal evenly, you can get an interest rate of 10% or more.”

Please constantly dig into it and use it according to each situation.Information on Agricultural Cooperative Federation jeonse loans

In any case, the financial sector can be used to borrow small money, and it can be used to increase profits and obtain economic benefits. You can generate income just by understanding and joining the market economy, and you can set the capital at an interest rate of about 4.00%, so you can take a little further. Of course, these are possible only when you have the condition that you have studied about the economic ecosystem, so if you aim for this, you should have the patience to study from trivial information to detail. Therefore, please carefully select and use efficient financial products as a more efficient means with a view to understanding the exact market situation through numerous channels at all moments.

Previous image Next image

Previous image Next image

Previous image Next image